An Action Plan To Tackle The Triple Crisis

By Dr Manuel Piñuela (CEO) and James Clifton (Chief Strategy Officer), Cultivo

Introduction

This year, on August 9th, the world was given a stark reality check from the IPCC. The new report (Sixth Assessment Report) has been described as a “code red for humanity" by UN Secretary-General António Guterres.

This report should serve as an urgent wake up call to leaders in public office, businesses and financial institutions to realise and address the severity of the triple planetary crisis, not just the climate crisis. We must remember that the IPCC report is not the only significant report from 2021. The Dasgupta Review released in February drew global attention, highlighting the severity of natural resource depletion and biodiversity collapse, and the importance of how economics accounts for the value of nature. This is a powerful reminder that the problem isn’t just global warming – biodiversity loss, water scarcity and poor water quality are just as important and interlinked. We have to address these three problems together and high quality nature-based projects do exactly this.

No longer can we allow any complacency – the triple threat of global warming, devastating biodiversity loss and a looming global water crisis affects us all and throws the future of our children and grandchildren into serious danger. Now is the time for clear action that combats the problem on all three fronts.

The Need for Action

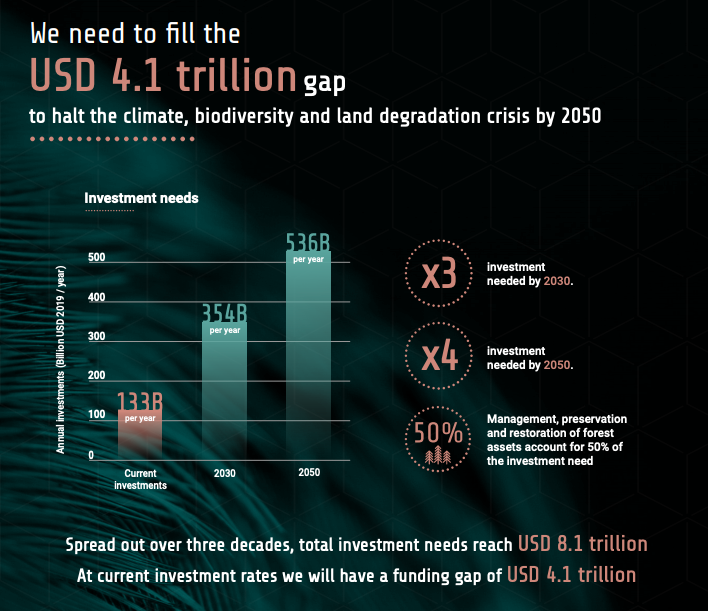

In May this year, UNEP published a sobering report on how the world needs $8.1 trillion of investment flowing into nature by 2050. Some of the key takeouts from the report are reproduced below.

Three-quarters of the land and two-thirds of the marine environment have been significantly altered by human actions. Since the beginning of civilisation, the world has lost half of its forests, half of coral reefs, 70 percent of wetlands and dammed two-thirds of the world’s main rivers. Wildlife populations have, on average, declined by 60 per cent since 1970 and there is the potential for our actions to cause the loss of 1 million species according to the most recent findings of the Intergovernmental Panel on Biodiversity and Ecosystem Services.

12 million ha of land are becoming degraded due to its unsustainable use every year, in addition to the two billion ha of already degraded land. Much of this land contains irrecoverable carbon, such as that found in peatlands, mangroves and old growth forest ecosystems. Furthermore, approximately 1.3 billion people are trapped on degrading agricultural land. Farmers on marginal land, especially in the drylands, have limited options for alternative livelihoods, and are often excluded from wider infrastructure and economic development. Recent estimates of the global loss of ecosystem services due to land degradation and desertification are between US$ 6.3 and 10.6 trillion annually.

The ongoing loss of nature has become a systemic risk for the global economy; the New Nature Economy report found over half the world’s GDP depends on nature. Yet, investing in nature offers the opportunity to generate United States Dollar (USD) 10 trillion in business value and create 395 million jobs. The Dutch Central Bank recently released a report “Indebted by nature”, quantifying the financial system’s dependence on nature. The report found that out of Euro (EUR) 1,400 billion analysed, EUR 510 billion were lent to or invested in sectors with high dependency on ecosystems, 36 per cent of the total assets of Dutch financial institutions. It concluded that financial institutions are exposed to reputational and transition risks when financing companies that have major negative impacts on biodiversity.

Nature-based Solutions (NbS) can provide up to 37 per cent of global cost- effective solutions to reduce the emission gap of 32 Gigatons to meet the targets under the Paris Climate Agreement. NbS also play a vital role in helping countries adapt to climatic change, being “cheaper, longer lasting and yielding more co-benefits than technology-based solutions”. In addition to the Paris Agreement, investment in nature can help meet the future targets in the post 2020 biodiversity framework of the Convention on Biological Diversity (CBD) and the UN Convention to Combat Desertification (UNCCD) Land Degradation Neutrality Targets as well as the Bonn Challenge of restoring 150 million ha of degraded and deforested landscapes by 2020 and 350 million ha by 2030 (Bonn Challenge).

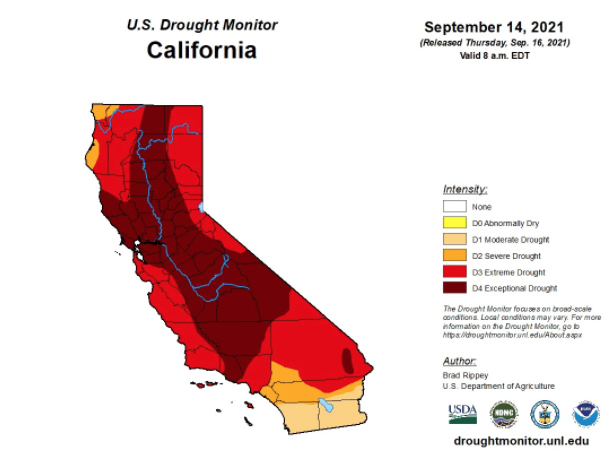

2.3 billion people live in water-stressed countries, of which 733 million live in high and critically water-stressed countries. 700 million people worldwide could be displaced by intense water scarcity by 2030. 72 percent of all freshwater withdrawals are used by agriculture making a transition to sustainable land use and agriculture essential. Water stress is a global crisis that acutely impact developing and developed countries alike. For example, in May 2021, 41 of the 58 California’s counties were in a declared drought emergency.

Source: US Drought Monitor, 2021

Action Plan for Unlocking Private Investment in Nature at Scale

There is a USD 4.1 trillion funding gap required to halt the climate, biodiversity and land degradation crisis by 2050. By 2050, total investment needs will amount to USD 8.4 trillion cumulatively, reaching over USD 536 billion per year, four times the amount invested today.

Image Source: UNEP, State of Finance for Nature, 2021

Currently, private capital makes up only 14% of funding for nature-based solutions. This is very low when compared to climate finance as a whole (which includes nature-based solutions), where 56% funding comes from private capital. Private capital companies include financial institutions (e.g. commercial & investment banks, asset managers, pension funds, venture capital and infrastructure funds), corporations (e.g. for profit legal entities) and foundations.

At Cultivo, we have been listening carefully to private capital companies to understand their challenges and needs when it comes to investing in nature-based solutions. Based on this market feedback, we believe there are five practical steps that can inform a practical, bottom-up action plan for unlocking private investment in nature at scale.

Five Practical Steps

1. Offer nature as an attractive asset for investment.

For private capital companies, it is often very difficult to evaluate a nature-based project as an investment. For example, where do the cash flows come from? What returns will I get ? What are the risks and how are they mitigated?

At Cultivo, we have an in-house investment team with world-class investment professionals who analyse every project with data and ask all the probing and difficult questions a private investor would do. We essentially take a nature-based project and package it into an investable product, showing the financial returns including ROCE, IRR, MOIC. We also show how the project will generate positive social and environmental returns, which is essential for a project to be high quality. By doing this we turn nature-based solutions into investment assets private investors can understand and appraise alongside other investment assets. We see this as being paramount in order to unlock private capital at scale into nature.

2. Use technology to reduce transaction costs and create market efficiencies

Private capital companies see transactional costs as a prohibitive barrier when it comes to investing in nature-based solutions. Firstly, the cost to search and originate high quality nature based projects is very high. Private investors often don’t know how to screen a pipeline of projects and identify the high quality ones. Secondly, the costs for the ongoing monitoring of projects can be high as they often rely on in-person inspections which can impact the profitability margins of a project.

At Cultivo, we use a proven suite of tools based on proprietary algorithms, remote sensor and ground truthing technologies to quickly identify high quality nature-based projects. This reduces the time taken to screen a pipeline of potential projects from months to hours, significantly reducing transaction costs. We also use these tools to provide digital monitoring, verification and reporting (MRV) to monitor the vital signs of a project and reduce the on-going monitoring costs. This technology shouldn’t be seen as a replacement for people or the experts on the ground - instead, it should be seen as transformative support. In the same way doctors rely on technology to help triage, monitor the vital signs of a patient and achieve improved clinical outcomes, technology can help experts and project developers achieve improved nature-based outcomes, thus ensuring strong financial, environmental and social returns.

An area we are also committed to developing is how blockchain technologies can be used to create trust and market efficiencies when it comes to selling offsets generated by a project.

3. Take a holistic approach.

A crucial step to tackling the triple crisis of climate change, biodiversity loss and water stress is to understand how closely they are interlinked. Private capital companies all too often focus on carbon (e.g. carbon capture, carbon offsets and net zero emissions). While this is important, it is only one part of the story. As we have seen already, the imperative to invest in nature is bigger than just climate change. Discussing the merits of carbon capture potential between a forest and direct-air-capture technology somewhat misses the point that over half the world’s GDP depends on nature and we have to protect and regenerate it.

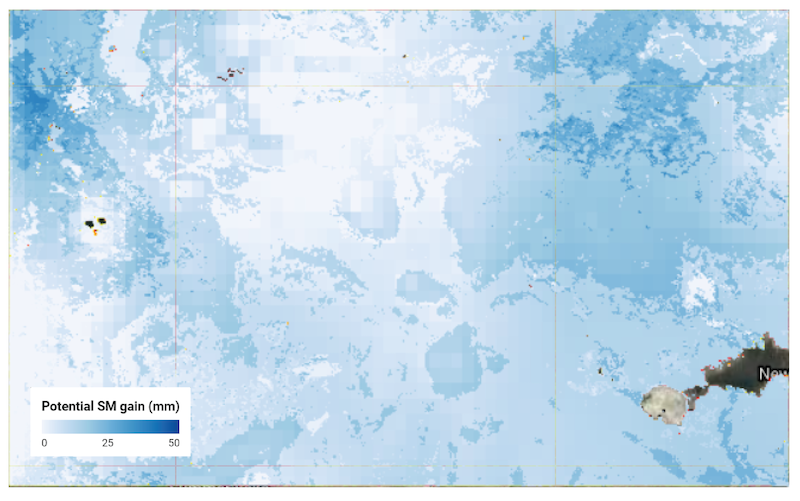

At Cultivo, we assess the ‘Natural Capital Density’ for every project, which means every layer of the services stack that nature provides (water, biodiversity, carbon, food etc.) For some projects, the layer that generates the most cash flows to a project is not carbon, but instead could be water offsets or the products generated from the land such as timber or food.

Therefore, from day one, the Cultivo Technology Hub has been designed to be much broader and deeper than just analysing carbon capture potential for a project. For example, we have tools that analyse biodiversity impact, water capture potential, and climate resilience.

Image source: Soil Moisture Potential Tool, Cultivo Technology Hub

4. Measure impact and choose the right standards.

One of the challenges private capital companies face is determining whether a nature-based project is ‘high quality’. This is especially true for corporations who are buying the offsets generated by a nature-based project as part of their net zero commitment. A recent report by Ceres and the IIGCC recommends that investors and corporates should make sure nature-based solutions they support do three things:

- Raise the ambition of climate commitments and support a solid decarbonisation strategy

- Provide credible climate change mitigation aligned to a recognized crediting standard

- Provide social and environmental benefits aligned to a recognized crediting standard

Measuring impact and choosing the right standards for a nature-based project can help address multiple crises in one. For example, the Climate, Community & Biodiversity Standard from Verra measures positive impact for climate, community and biodiversity.

At Cultivo, we prioritize standards such as the CCB where possible. Where it is not possible to align to a standard such as the CCB given the design of a particular project, we ensure every project has environmental and social safeguards and we measure multiple attributes, including the impact of biodiversity, land degradation levels and increased soil moisture retention using our tools in the Cultivo Technology Hub.

5. Make data transparent

Lack of data disclosure and quality is a consistent theme that we hear from the private capital companies we speak to, and is a major impediment to unlocking investment in nature at scale. Pricing information for offsets is often opaque and a lack of standardization means investors struggle to be able to compare apples to apples for different projects. Transparency is the foundation that trust and credibility is built upon. From a top-down level, initiatives such as the Taskforce for Scaling Voluntary Carbon Markets will hopefully help drive standardisation.

From a bottom-up perspective, at Cultivo we make all the information for our projects transparent to our investors and offtakers. This includes our financial analysis, land rights data, suppliers, project developers, technical analysis of the projects from both our tools and experts on the ground, performance and pricing. We believe the key is to provide data and information for private investors in a way they can understand so they can make an informed decision.

Conclusion

We must take a holistic approach when it comes to investing in nature. The triple crises of climate change, biodiversity loss and water stress are interconnected and we must address them together with high quality nature-based solutions and with urgency.

The ongoing loss of nature has become a systemic risk for the global economy, and threatens the lives of millions of people around the world. We need to unlock investment in nature at scale and at speed.

For a PDF version of this Action Plan that includes all citations and footnotes please click here